News

European Foundry Industry Sentiment

Tweet

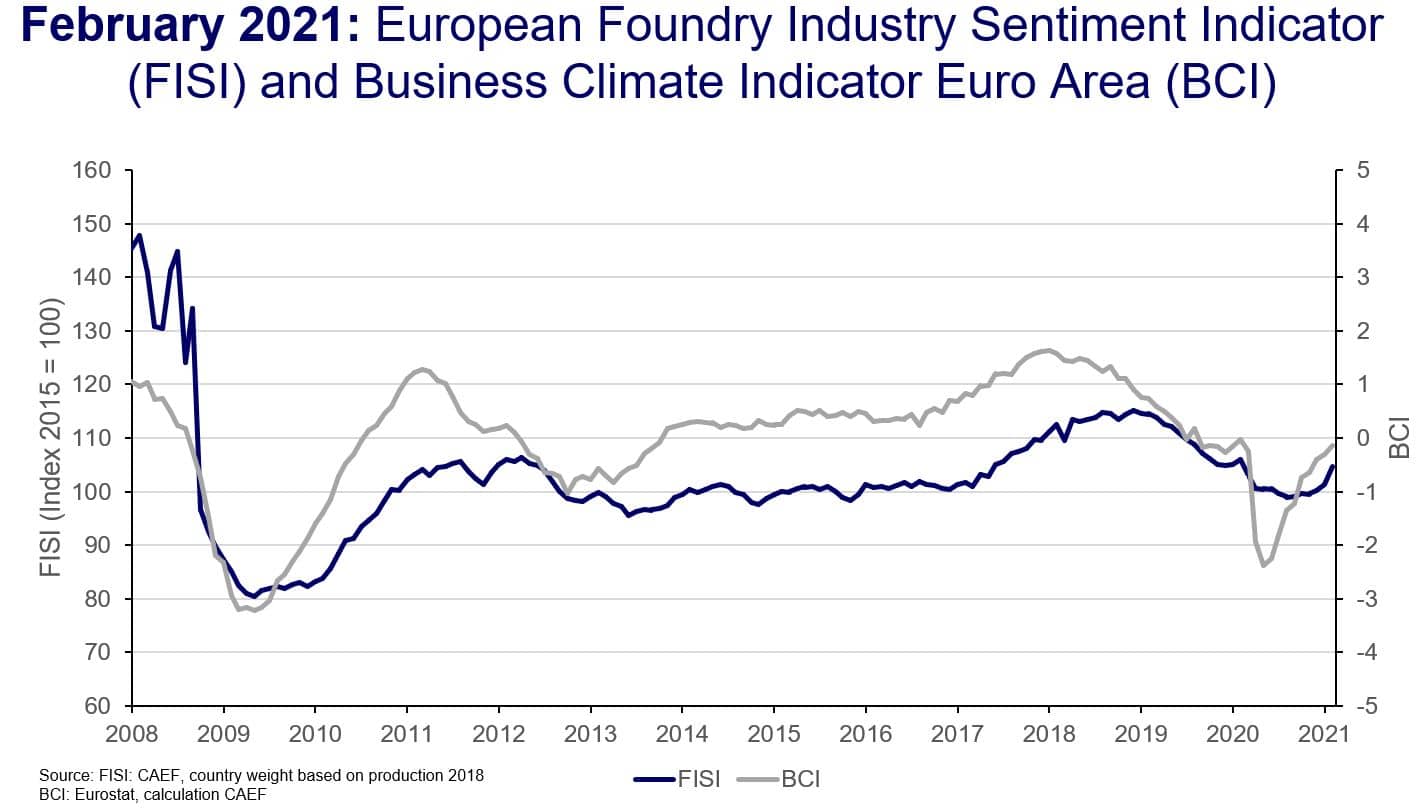

The Business Climate Indicator increases by a significant 3.4 index points in February, reaching a value of 104.7 points. Only once in the past ten years the industry has reported a higher increase within one month. The driving force behind this significant improvement is a more positive assessment of the current situation in all three material groups — steel, ferrous and non-ferrous.

Such a dynamic improvement gives reason to be optimistic about a robust recovery, although despite these very positive assessments by European foundries, the further development remains uncertain. While discussions about easing restrictions may have strengthened the industry’s outlook in some countries last month, the infection figures are already on the rise again in many regions. Also, in some European countries, the recent discussions about vaccines and delays in their distribution will only be reflected in the upcoming sentiment analysis.

Meanwhile, the good figures of the European foundry industry are supported by the broad economic recovery in the Eurozone, as the Business Confidence Indicator (BCI) continues to recover. With an increase of 0.2 points, the index has risen for the ninth month in a row.

The FISI – European Foundry Industry Sentiment Indicator – is the earliest available composite indicator providing information on the European foundry industry performance. It is published by the European Foundry Association (CAEF) every month and is based on survey responses of the European foundry industry. The CAEF members are asked to give their assessment of the current business situation in the foundry sector and their expectations for the next six months.

The BCI – Business Climate Indicator – is an indicator published by the European Commission. The BCI evaluates development conditions of the manufacturing sector in the euro area every month and uses five balances of opinion from industry survey: production trends, order books, export order books, stocks and production expectations.

CAEF Contact:

Tillman van de Sand

Secretary Commission for Economics & Statistics

phone: +49 211 68 71 — 301

mail: tillman.vandesand@caef.eu

Source: CAEF

Tweet

Related News

- Stay Ahead in Nonferrous and Lightweight. Follow Diecasting & Nonferrous China 2026

- European Foundry Industry in Transition – New Opportunities Through the Defense Sector

- Global pig iron production fell by 4.4% y/y in October

- India sharply increased iron ore imports by more than 200% y/y in January-October

- EU plans to limit exports of aluminium scrap

- Calderys Group celebrates 160 years of innovation and industrial excellence

- Foundries in Transition: Why Humanoid Robots Are Now in Demand

- Iron ore exports from Brazil increased by 5.7% y/y in January-October

- See all News