News

Bulk Buys: Iron ore hits astonishing $US230/t, upside remains

Tweet

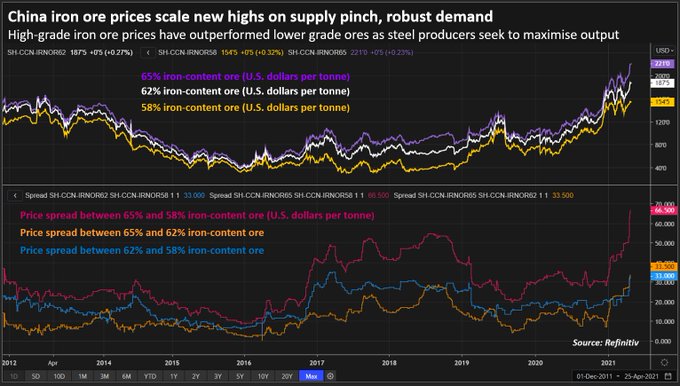

Iron ore hit a heady $US230/t yesterday and, in the process, blew every expert forecast out of the water.

China loves a whinge, but right now they need our iron ore to feed their ravenous construction and manufacturing sectors.

Importantly, domestic steel prices and mills’ profit margins are still on a rising trend, Roskill says.

Meanwhile, steel production in the rest of the world is recovering after posting a near 8% year-on-year decline in 2020.

Iron ore prices have not only been pulled up by a strong demand and high steel prices, but supply, mostly from Brazil, has also been constrained.

There have also been a lot of fires.

The experts at Roskill reckon iron ore prices will continue to surprise to the upside.

“… iron ore supply will remain constrained for the rest of 2021 and possibly into 2022,” it says.

“In the next couple of years, China’s steel production will peak and with the development of Electric Arc Furnaces (EAFs), a decoupling between pig iron and steel production will take place.

“Softening steel prices in H2 2021 could also translate into lower iron ore prices, but overall Roskill believes that they will remain stronger for longer than market expected.”

Here’s how ASX-listed iron ore stocks are performing:

Scroll or swipe to reveal table. Click headings to sort. Best viewed on a laptop

Small Cap Standouts

Red Hill Iron (ASX:RHI) continues to find strong demand from investors, posting a red hot 14-day RSI of 95 as iron ore prices pushed above $US200/tonne.

Red Hill has a 40 per interest in the Red Hill joint venture project in WA’s West Pilbara region in partnership with Aquila Steel, part of China’s Baosteel Group.

Mine developer Magnetite Mines (ASX:MGT) was up 28% after announcing a share placement at a premium to its recent trading price.

Brand new iron ore producer GWR Group (ASX:GWR) gained last week, although sadly one of its contractor’s trucks rolled over, resulting in a fatality.

Venture Minerals (ASX:VMS) is on track to be Australia’s next iron ore miner at its Riley mine in northwest Tasmania.

On April 21 the company said it was just two weeks from commissioning the plant.

“This timing puts the first iron ore shipment on track for this quarter and puts the company in a strong position to take advantage of the historically high iron ore prices,” Venture Minerals managing director Andrew Radonjic says.

Also making significant gains were major producers BHP (ASX:BHP), Rio Tinto (ASX:RIO), Mount Gibson Iron (ASX:MGX) and Fortescue Metals Group (ASX:FMG).

Source: stockhead.com.au

Tweet

Related News

- Stay Ahead in Nonferrous and Lightweight. Follow Diecasting & Nonferrous China 2026

- European Foundry Industry in Transition – New Opportunities Through the Defense Sector

- Global pig iron production fell by 4.4% y/y in October

- India sharply increased iron ore imports by more than 200% y/y in January-October

- EU plans to limit exports of aluminium scrap

- Calderys Group celebrates 160 years of innovation and industrial excellence

- Foundries in Transition: Why Humanoid Robots Are Now in Demand

- Iron ore exports from Brazil increased by 5.7% y/y in January-October

- See all News