News

What Happens When the World’s Key Metal Exchange Has No Metal?

Tweet

What happens when the London Metal Exchange runs out of metal? That’s the question the exchange is urgently trying to address for its flagship copper contract, which sets the global price for one of the world’s most important commodities.

The problem stems from the LME’s physical nature: anyone holding a contract to expiry becomes the owner of a package of metal in an LME warehouse. On the other hand, anyone who has sold one must deliver the metal when the contract expires.

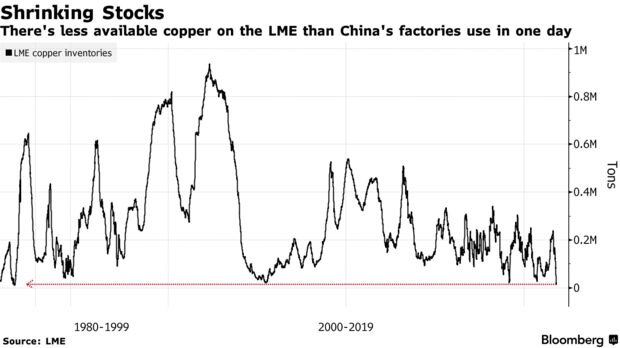

But with available copper inventories at LME warehouses falling below 20,000 tons -- less than China’s factories consume in one day -- traders are grappling with the possibility that there simply won’t be metal available to deliver.

The dramatic drop in stockpiles that began in August and accelerated this month has sent the nearest LME contracts spiking to record premiums over copper for later delivery. That’s particularly painful for copper fabricators -- companies that turn basic metal into things like wires, plates and tubes, and who tend to sell LME futures to hedge their price exposure.

But the emptying warehouses have also helped drive benchmark prices toward record levels and copper’s pervasive role in the world means that the jump in costs will add to wide-reaching inflationary pressure for manufacturers and builders. And while mounting threats to global economic activity are raising questions about the outlook for copper demand, inventories on Chinese and U.S. rivals to the LME are also low.

Source: Waupaca Foundry

Tweet

Related News

- Stay Ahead in Nonferrous and Lightweight. Follow Diecasting & Nonferrous China 2026

- European Foundry Industry in Transition – New Opportunities Through the Defense Sector

- Global pig iron production fell by 4.4% y/y in October

- India sharply increased iron ore imports by more than 200% y/y in January-October

- EU plans to limit exports of aluminium scrap

- Calderys Group celebrates 160 years of innovation and industrial excellence

- Foundries in Transition: Why Humanoid Robots Are Now in Demand

- Iron ore exports from Brazil increased by 5.7% y/y in January-October

- See all News