News

Iron ore price up despite Chinese steel curbs

Tweet

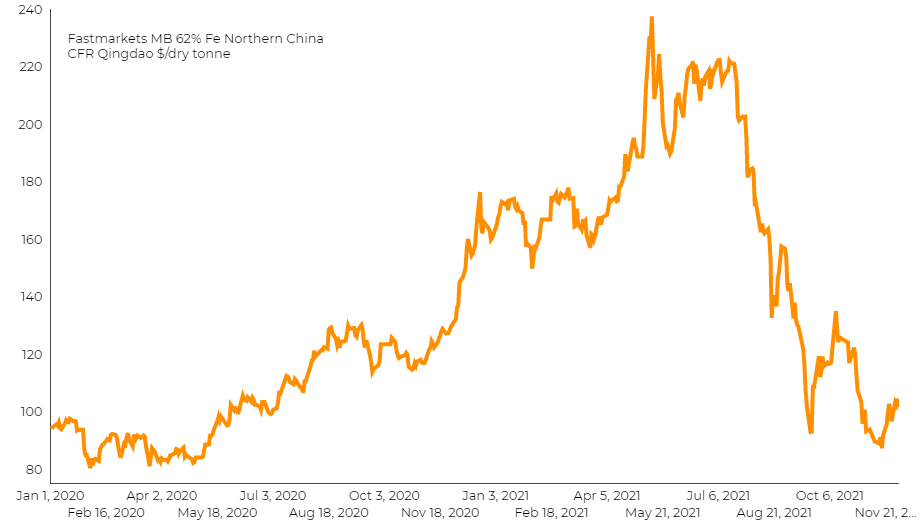

The iron ore price rose on Friday even as production at steel mills stayed sluggish amid government curbs in China.

Capacity utilisation rates of blast furnaces at 247 steel firms across the country declined for the seventh straight week and stood at 74.8% as of Friday, down from 75.2% a week earlier, according to Mysteel consultancy.

Benchmark iron ore futures on the Dalian Commodity Exchange, for May delivery, were down 3.6% to 603 yuan ($94.61), as of 0330 GMT, after declining as much as 5.5% in morning trade. For the week, however, the contract was on course for a 4.8% gain.

“Impact from changes to the supply side on steel products prices is weakening,” SinoSteel Futures wrote in a note, referring to output controls during winter.

However, with the real estate market remaining weak, steel prices are not expected to gain significantly, SinoSteel Futures said.

Source: mining.com

Tweet

Related News

- Stay Ahead in Nonferrous and Lightweight. Follow Diecasting & Nonferrous China 2026

- European Foundry Industry in Transition – New Opportunities Through the Defense Sector

- Global pig iron production fell by 4.4% y/y in October

- India sharply increased iron ore imports by more than 200% y/y in January-October

- EU plans to limit exports of aluminium scrap

- Calderys Group celebrates 160 years of innovation and industrial excellence

- Foundries in Transition: Why Humanoid Robots Are Now in Demand

- Iron ore exports from Brazil increased by 5.7% y/y in January-October

- See all News