News

Iron ore price recovers despite economic weakness in China

Tweet

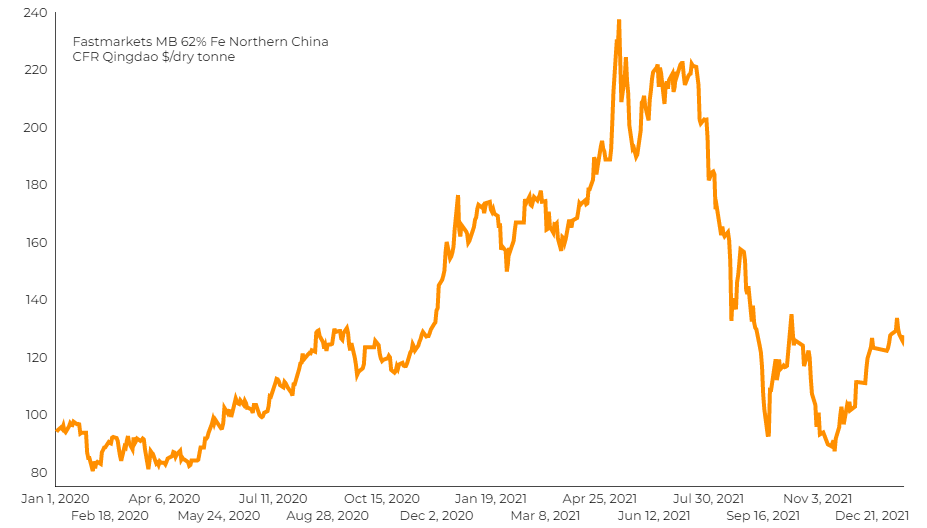

The iron ore price recovered from losses on Tuesday even as consumption by the construction sector remained weak in China, with mills cutting production ahead of holidays.

According to Fastmarkets MB, benchmark 62% Fe fines imported into Northern China were changing hands for $127.65 a tonne during morning trading, up 1.6% compared to Monday’s closing.

Around 50 steelmakers have announced maintenance plans near the coming Lunar New Year holidays, with some producers planning to resume production in late February or March, according to consultancy Mysteel.

China’s gross domestic product in the property sector fell 2.9% in the fourth quarter of 2021 compared with the same period a year earlier, data from the National Bureau of Statistics showed.

“Consumption remains the weakest link in China’s growth story at the moment and that will by and large continue for much of this year,” said Louis Kuijs, head of Asia economics at Oxford Economics.

Brazilian miner Vale SA is resuming production after heavy rains and said its annual iron ore production guidance remained at 320-335 million tonnes.

Meanwhile, Rio Tinto expects its 2022 iron ore shipments from the Pilbara region at 320-335 million tonnes, slightly weaker than expected, due to labour market conditions.

Source: mining.com

Tweet

Related News

- Stay Ahead in Nonferrous and Lightweight. Follow Diecasting & Nonferrous China 2026

- European Foundry Industry in Transition – New Opportunities Through the Defense Sector

- Global pig iron production fell by 4.4% y/y in October

- India sharply increased iron ore imports by more than 200% y/y in January-October

- EU plans to limit exports of aluminium scrap

- Calderys Group celebrates 160 years of innovation and industrial excellence

- Foundries in Transition: Why Humanoid Robots Are Now in Demand

- Iron ore exports from Brazil increased by 5.7% y/y in January-October

- See all News