News

How Has Russia’s Ukraine Invasion Impacted the Commodity Markets?

Tweet

Russia’s ongoing invasion of Ukraine continues to take an incredible human toll, with the very latest updates from the Office of the United Nations revealing that some 4,509 civilians had been killed in the conflict to date.

However, this geopolitical conflict has also caused significant financial and market disruption, from compounding the rise in global energy prices to significantly disturbing the world’s agricultural space.

But how exactly has this industry been impacted to date, and what does the conflict mean for the global commodity markets as a whole?

The Price of Goods Continues to Rise

According to recent datasets collated by Eurostat, the average price of agricultural goods and services increased by 9.5% year-on-year in Q1 2022.

This was driven primarily by a 21.4% hike in the price of fertilisers and soil improvers, while the cost of animal feed also increased by 9.2% during the same period. Currently, Russia and Belarus are key fertiliser exporters to the global market, while Ukraine supplies a significant portion of the world’s corn and sunflower oil.

Of course, agriculture has also been adversely impacted by rising energy costs. Because of this, the energy costs absorbed by farms increased by 17.4% during Q1, highlighting the significant fiscal challenges facing agriculture in 2022.

While the average price of agricultural output also increased during the reporting period, a rise of approximately 6% wasn’t necessarily enough to compensate for the wider cost hikes and general economic downturn.

How has the Wider Commodity Market Been Affected?

Of course, the rising cost of agricultural goods and services has benefited suppliers in the industry, with the Wynnstay Group reporting record interim results through 2021 that far exceeded management forecasts.

But what about the rest of the commodities market? Well, the war in Ukraine has impacted prices in two significant ways, the first of which involved the erection of physical blockades and the destruction of productive capacity in the war-torn European nation.

Production has also been impacted by the ongoing financial sanctions imposed on Russia, which is considered to be the world’s largest exporter of pig iron, wheat, nickel and natural gas.

It also accounts for a considerable share of global crude oil, coal and refined aluminium exports, creating a scenario where production of these commodities has continued to fall through 2022.

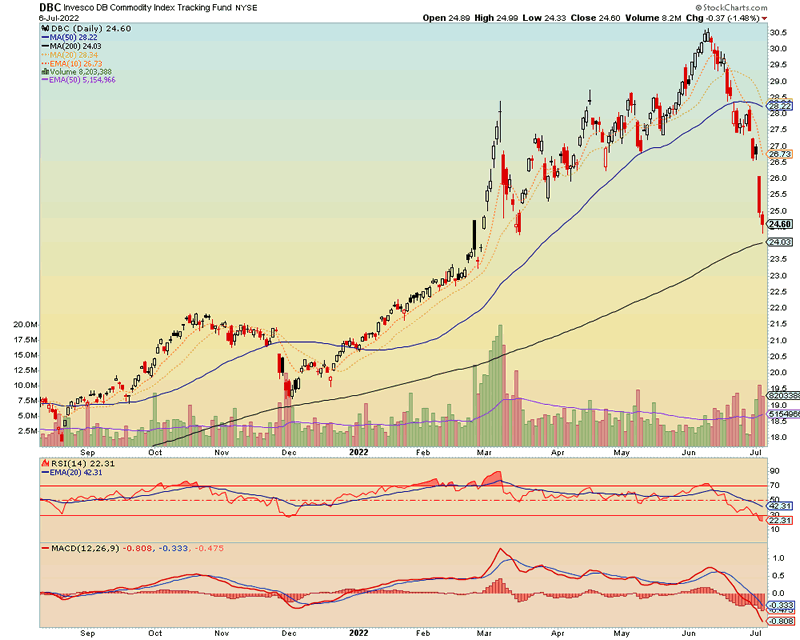

More specifically, we’ve seen the balance between supply and demand for these commodities dramatically disrupted during the last couple of quarters, with demand continuing to outstrip supply on a global scale. This is the primary cause of rampant price hikes, although there are signs that this trend is finally beginning to reverse.

While global wheat prices traded at a record high of $12.94 a bushel on March 7th, for example, it has since declined by 27% to just $9.39 as of June 28th.

This may have something to do with discussions between Russia and Turkey, who are considering the development of a safe passage in the Black Sea through which to ship Ukrainian grain. Of course, there’s no guarantee that such a route can be found, particularly given the destruction of ports and need to de-mine seaways.

However, it has been enough to improve market sentiment in the short-term, while increasing liquidity and making it easier to buy and sell affected commodities in real-time.

Regardless, this will remain an interesting space to watch in the future, with the increased volatility and uncertainty in the commodities market creating a significant challenge for all parties involved.

By Travis Bard

Source: marketoracle.co.uk

Tweet

Related News

- Stay Ahead in Nonferrous and Lightweight. Follow Diecasting & Nonferrous China 2026

- European Foundry Industry in Transition – New Opportunities Through the Defense Sector

- Global pig iron production fell by 4.4% y/y in October

- India sharply increased iron ore imports by more than 200% y/y in January-October

- EU plans to limit exports of aluminium scrap

- Calderys Group celebrates 160 years of innovation and industrial excellence

- Foundries in Transition: Why Humanoid Robots Are Now in Demand

- Iron ore exports from Brazil increased by 5.7% y/y in January-October

- See all News